In the beginning of April, Europe officially finished the heating season and began pumping gas into underground storage facilities. Despite heightened geopolitical uncertainty, sanctions apparently somehow managed to circumvent the issues of Russian LNG supplies to Europe. In March, Russia supplied 2.15 billion cubic meters LNG to the European Union, this is the second highest supply volume rate following the United States. Does LNG have a potential to build a bridge in Russia-Europe relations? Still premature to have that discussion, but obviously LNG fares better than pipeline gas.

Thus, we witnessed a bad mouth towards Russia on the cessation of natural gas supplies to Germany. On the one hand, he is right. Russia stopped supplies via the Yamal - Europe gas pipeline, and also stopped supplies via Nord Stream (before the attack on the gas pipeline). However, supplies through Yamal - Europe were stopped in response to EU sanctions due to the impossibility of payments for gas transit through the Polish section of the gas pipeline. Is Poland ready to pump gas for free? They “forgot” to ask Poland on this matter. Pumping through Nord Stream stopped due to the fact that anti-Russian sanctions made it impossible for the German company Siemens Energy to supply and maintain equipment at the Portovaya compressor station (currently maintained by Gazprom), which the company is obliged to do under the contract.

The world's top LNG trader Shell estimates that rising global demand for LNG is expected to keep pace with new supply. Much of this growth will happen within a decade from LNG at the expense of building new facilities and terminals. This conservative scenario shows the overall supply growth to only a few tens of million tons of LNG in 2030s till 2040, while there will be enough liquefaction facilities in operation and under construction.

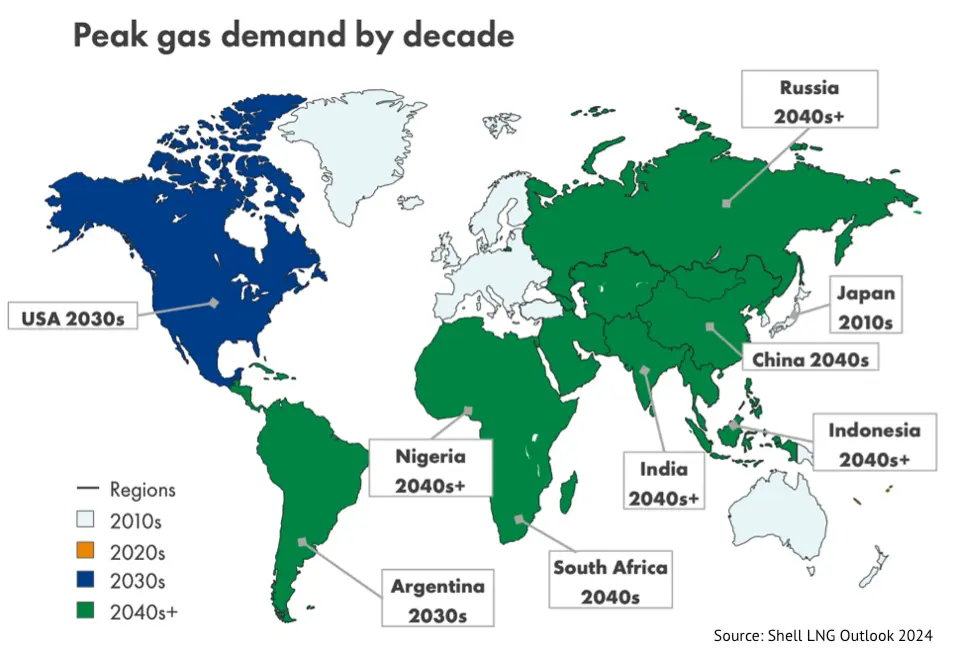

Photo: Shell LNG Outlook 2024

Explanations for the weak gas demand in the future may vary. The development of renewable hydrogen and a continued decline in solar energy systems create a favorable ground for such generation volume increase. Also, photovoltaic energy technologies adopted for operation in extremely low temperatures are of special focus; today such facilities are used in China, Norwegian Svalbard, and Canada. As a result, the jump towards electrification will continue, but natural gas no longer has a significant place in this increase in generation.

Despite the fact that Russia has become the fourth largest LNG producer in the world, accounting for approximately 8% of the global LNG market, and aims to increase its share to 20% by 2035, the real situation is that the country faces a shortage of ice-class LNG tankers and a lack of large gas turbines of large capacity that fit pump-compressor equipment. In retaliation, Russia is reducing natural gas production, since there is nowhere to store reserves and nothing to export them.

Russian experts say that tankers are most likely to be purchased on the secondary market, rather than chartered, since the owners of LNG tankers do not want to get involved with sanctioned production facilities under the threat of secondary sanctions on their vessels. The market for such vessels is much more limited than for oil tankers, thus it is hardly believed that solutions for the Arctic LNG-2 can be found shortly. It is noteworthy that in 2017 Bloomberg wrote Russia wins in Arctic after U.S. fails to kill another giant gas project - Yamal LNG: “Russians have got it running and that is a bit of a triumph for them that underlines again that sanctions struggle to be effective“.

Currently, both projects are being slowed by production difficulties. Considering the growing challenges in this field, it is debatable that Russia needs to create the entire technological chain in the LNG sector, ranging from all liquefaction components production to ice-class LNG vessels. The shift of all timelines inevitably raises questions about how these plans resonate with the expected peak gas and LNG around 2040. In other words, will it be possible to find long-term demand for Russian LNG facilities to be launched after 2030?

Ekaterina Serova